Massachusetts, USA Businesses Turn to Outsourced Finance and Accounting for Cost-Effective Solutions

Massachusetts businesses turn to outsourced finance and accounting to boost efficiency, reduce costs, and ensure compliance.

Empower your business with expert outsourced finance solutions today! Click here

In Massachusetts, businesses are facing mounting inflationary pressures, heightened regulatory demands, and labor shortages, all of which are pushing organizations to seek outsourced finance and accounting in Massachusetts as a solution to remain competitive. This trend toward outsourcing finance and accounting functions is gaining momentum as firms focus on optimizing costs, ensuring compliance, and enhancing financial flexibility. By tapping into outsourced expertise, companies can mitigate risk, streamline operations, and sharpen their focus on long-term growth strategies.

"The growing demand for outsourced finance and accounting in Massachusetts reflects a shift toward operational efficiency, where businesses can leverage external expertise to manage complex financial tasks and focus on long-term growth goals." said Ajay Mehta, CEO of IBN Technologies.

As businesses navigate an increasingly complex regulatory environment, maintaining in-house finance teams capable of managing the demands of evolving financial regulations is becoming a daunting task. Stricter tax laws and regulatory frameworks necessitate constant oversight, putting significant strain on businesses. Moreover, the rising costs associated with infrastructure, software upgrades, and data security are leading many to reconsider the viability of maintaining large in-house teams. This is where outsourced finance and accounting in Massachusetts becomes a viable and attractive option for many businesses.

Beyond compliance challenges, outdated financial systems exacerbate inefficiencies in transaction processing, reporting, and reconciliation, contributing to delays and increasing the risk of errors. These inefficiencies disrupt operations, hinder accurate financial forecasting, and prevent companies from maintaining liquidity. Businesses undergoing rapid expansion or facing seasonal fluctuations often struggle to scale their financial operations efficiently, which can lead to bottlenecks that affect profitability. Outsourced finance and accounting in Massachusetts provide the scalability businesses need to adjust their financial operations according to demand, ensuring smooth operations even during times of growth or economic uncertainty.

"Outsourcing finance functions in Massachusetts enables businesses to manage complex financial tasks more efficiently, ensuring they can scale operations, reduce errors, and focus on their core growth strategies. “Stated Mehta.

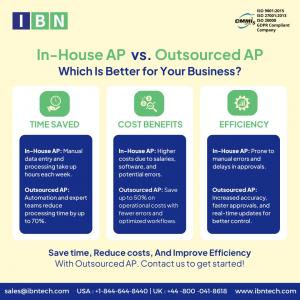

Outsourcing finance functions presents a solution to these challenges by providing companies with access to specialized financial expertise while reducing the burden of maintaining large internal teams. Outsourced services offer skilled professionals capable of managing complex tasks such as tax preparation, bookkeeping, and payroll processing. Additionally, outsourcing offers the flexibility to scale financial operations according to demand, making it easier to manage periods of growth or economic uncertainty.

Ready to improve your bookkeeping? Start with a free consultation today!

https://www.ibntech.com/free-consultation/?pr=EIN

This approach is increasingly being customized to meet the unique needs of various industries. In healthcare, for instance, outsourced finance services ensure compliance with HIPAA regulations, streamline insurance claim processing, and optimize revenue cycle management. Real estate businesses benefit from outsourced solutions that facilitate lease accounting, rental income tracking, and property tax optimization. Similarly, in the retail and e-commerce sectors, outsourced services help manage multi-channel sales tax automation, inventory reconciliation, and payment tracking, boosting operational efficiency and financial oversight.

Manufacturing and logistics companies also leverage outsourcing to manage supply chain costs, optimize invoicing accuracy, and mitigate financial risks, thus improving overall operational performance. By customized finance solutions to meet the specific requirements of various industries, outsourcing providers are offering businesses the tools they need to succeed in an increasingly competitive market.

In addition to industry-specific solutions, outsourcing finance and accounting functions offers significant cost savings. By eliminating the need for large in-house teams, companies can reduce overheads while ensuring compliance with financial standards and tax laws. This financial flexibility makes outsourcing an attractive option for businesses looking to cut operational costs and reallocate resources toward strategic goals such as expansion, mergers, and market penetration.

The scalability of outsourced finance services further enhances their value. Businesses can adjust their financial needs quickly, ensuring that operations continue to run smoothly during periods of growth or economic uncertainty. The ability to scale financial functions on-demand is a crucial advantage in today’s dynamic business environment.

Another factor driving the adoption of outsourced services is the integration of modern financial tools. Cloud-based platforms enable businesses to access real-time financial data, streamlining financial processes and enhancing decision-making. These tools improve security through encrypted transactions and provide flexibility to scale operations as needed. Furthermore, financial analytics software allows businesses to gain predictive insights, enabling more accurate forecasting and smarter decision-making.

Unlock customized bookkeeping solutions—request a pricing quote today!

https://www.ibntech.com/pricing/?pr=EIN

Outsourcing providers are increasingly integrating these tools into their service offerings, which helps improve efficiency, accuracy, and transparency. By leveraging cutting-edge tools, outsourcing companies help businesses optimize their financial operations, which in turn supports better decision-making and financial stability.

Looking ahead, the demand for outsourced finance and accounting services in Massachusetts is poised for significant growth as businesses continue to face financial pressures. IBN Technologies is helping companies navigate these challenges by offering expert support, allowing businesses to offload complex financial functions. This enables them to focus on core activities while enhancing their ability to stay agile in an ever-changing economic landscape. As cloud-based platforms and advanced financial tools gain traction, the role of outsourced finance and accounting in Massachusetts becomes even more vital in supporting business success.

IBN Technologies is leading the way in helping businesses prioritize cost-effectiveness, compliance, and flexibility through External Finance and Accounting Services. Their expert solutions play a pivotal role in ensuring operational efficiency by mitigating financial risks, strengthening financial controls, and enhancing long-term business success. By partnering with IBN Technologies, companies can streamline their financial operations, allowing them to focus on strategic growth while maintaining stability in a competitive global market.

Source Link:

https://www.ibntech.com/article/outsourced-finance-and-accounting-services-usa/?pr=EIN

Related Services:

1) Catch-up Bookkeeping/ Year End Bookkeeping Services

https://www.ibntech.com/ebook/catch-up-bookkeeping-guide-for-financial-and-tax-success/?pr=EIN

2) AP/AR Management

https://www.ibntech.com/accounts-payable-and-accounts-receivable-services/?pr=EIN

3) Tax Preparation and Support

https://www.ibntech.com/us-uk-tax-preparation-services/?pr=EIN

4) Payroll Processing

https://www.ibntech.com/payroll-processing/?pr=EIN

5) USA Bookkeeping Services

https://www.ibntech.com/bookkeeping-services-usa/?pr=EIN

About IBN Technologies

IBN Technologies LLC, an outsourcing specialist with 25 years of experience, serves clients across the United States, United Kingdom, Middle East, and India. Renowned for its expertise in RPA, Intelligent process automation includes AP Automation services like P2P, Q2C, and Record-to-Report. IBN Technologies provides solutions compliant with ISO 9001:2015, 27001:2022, CMMI-5, and GDPR standards. The company has established itself as a leading provider of IT, KPO, and BPO outsourcing services in finance and accounting, including CPAs, hedge funds, alternative investments, banking, travel, human resources, and retail industries. It offers customized solutions that drive efficiency and growth.

Pradip

IBN Technologies LLC

+1 844-644-8440

sales@ibntech.com

Visit us on social media:

Facebook

X

LinkedIn

Instagram

YouTube

Distribution channels: Business & Economy

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release